Volatility Is a Feature

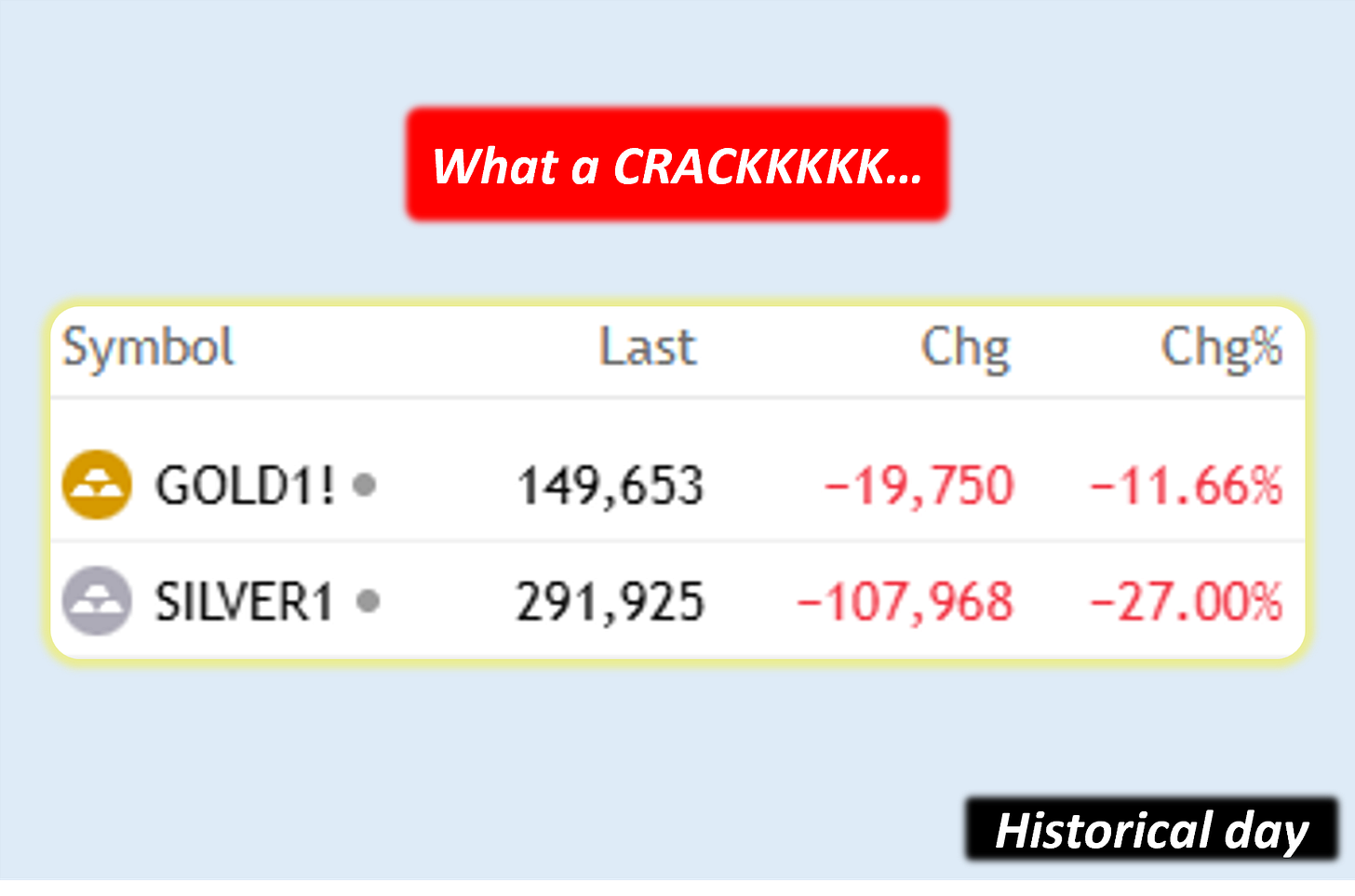

- Commodities stole the spotlight; Gold, Silver & Copper saw wild moves with upper & lower circuits

- NIFTY -2.5%, Inside Bar at 50W EMA. Tested its 50W EMA for the first time since April 2025

- Banks held up relatively better, once again showing strength

- Metal Index cracked 5%+ in a single session, reminding everyone why risk management matters

⦿ What we traded this week

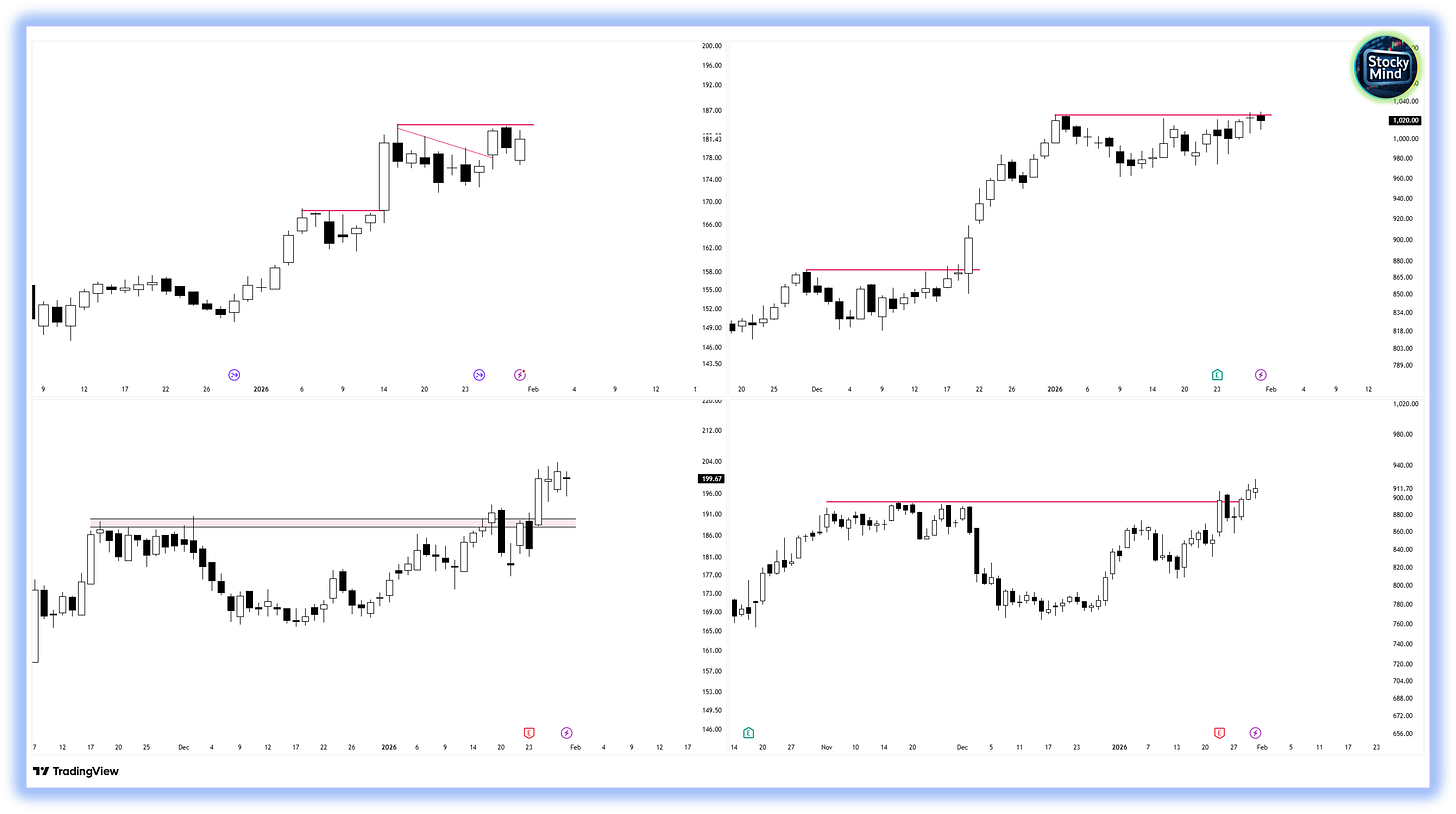

✔ HINDCOPPER (37%+ move)💰

✔ UNIONBANK (₹25k+ per lot)💰

Booked, logged, and moved on.

⦿ Sector & Stock Highlights

- Auto index showed some bounce from the support zone.

- Banks continue to show relative strength

- Some defence stocks bounced, but only from lows; we prefer strength with consolidation, not emotional rebounds. We wait!

- GROWW, UNIONBANK, DCBBANK, SHRIRAMFIN

⦿ Game Plan

✔ Let budget-related volatility cool off

✔ Stay light, not aggressive5

✔ Capital protection > activity

⦿ From the Stocky Mind Community

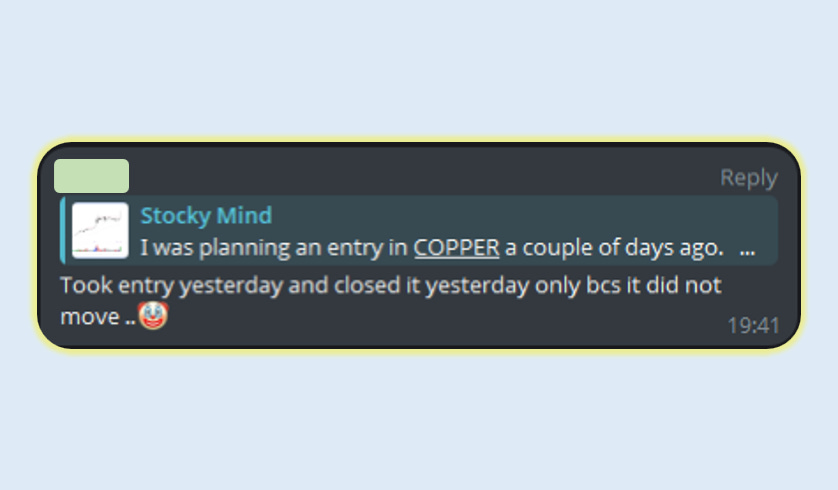

One of our members entered COPPER but exited early, missing the upper circuits; something many of us faced too.

Lesson:

Missed trades can be revisited.

Forced trades cannot be undone.

Discipline always pays, eventually.

⦿ Quote of the Week

“Markets don’t punish impatience immediately; they reward patience eventually.”

See you in the next pulse with Stocky Mind Pulse – 39 🙌🏻

If you liked this issue, share it with your trading friends.

Let’s grow smarter together 💪🏻

Best Regards,

Stocky Mind ⚡️

⚠️ Disclaimer

The information shared in this newsletter is for educational and informational purposes only.

It is not financial advice or a recommendation to buy or sell.

Please do your own research or consult a certified financial advisor before making any trading or investment decisions.