A Market That Rewards Patience

- NIFTY hits an all-time high after 290 days.

- GOLD & SILVER were on the run again this week, with SILVER hitting a new ATH 1,72,099; forming its biggest bullish candle since 2015.

- Broader markets, especially mid & small caps, stayed sluggish again.

- Major indices took a breather near highs after Wednesday’s sharp bounce.

⦿ What we traded this week

- UJJIVAN$FB:

· Strong structure near 52-week high

· Clean breakout post Q2 FY26 earnings

· Clear relative strength vs the broader market· Only trade taken due to weak participation from mid & small caps

· Capital preservation > random trades.

Good weeks are the ones where you avoid forced action.

⦿ Game Plan

✔ Focus only on strong stocks trading near their highs

✔ Avoid bottom-fishing in illiquid or beaten-down names

✔ Keep position sizing tight; volatility clusters near ATH levels

✔ Let the leaders lead

✔ Have fewer but high-probability trades

✔ Stay patient

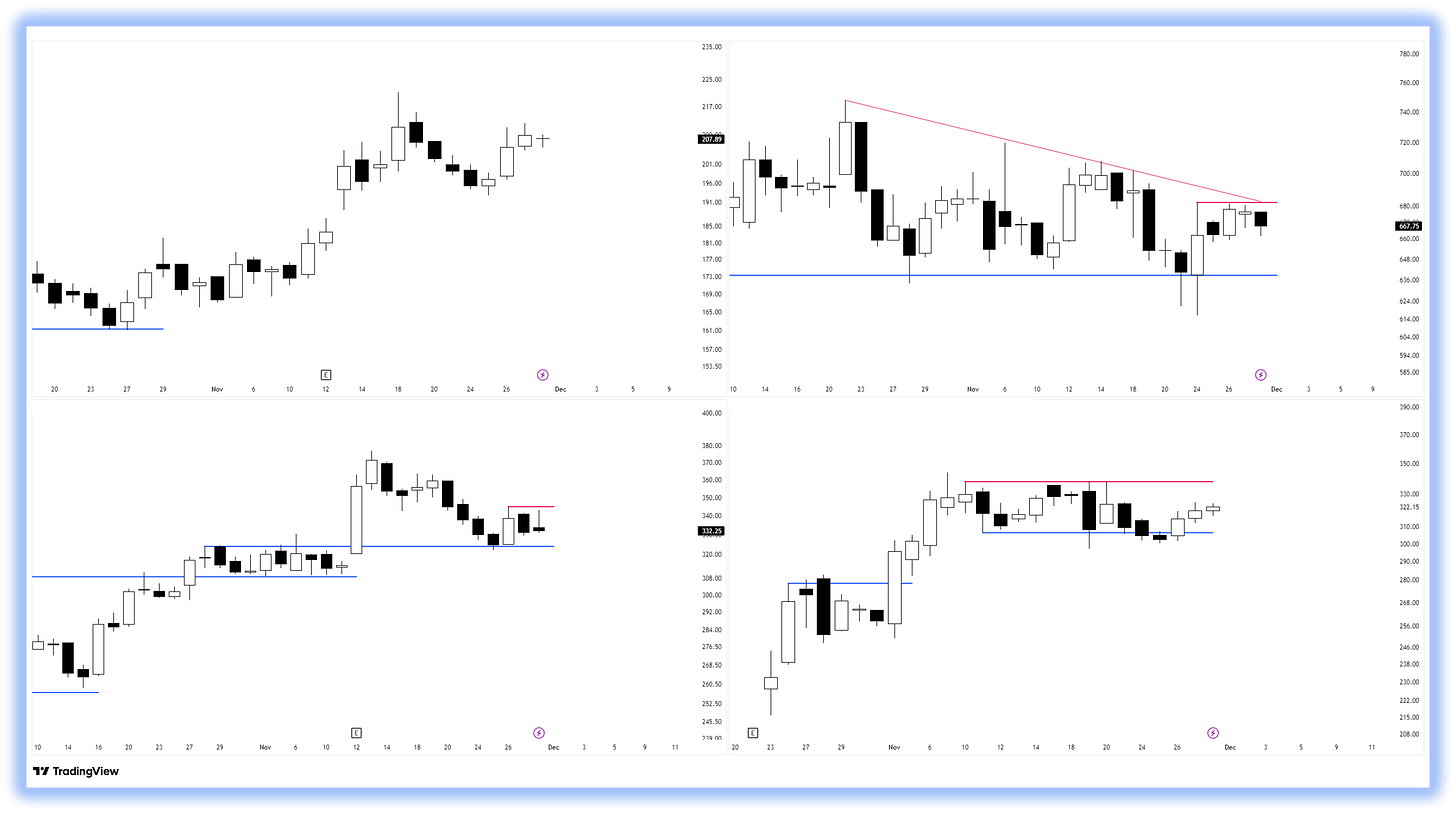

⦿ Sector & Stock Highlights

- Sectors:

- Auto knocking at the resistance zone for a breakout above the ATH.

- PSUBANKS Up nearly 20% post-breakout (September).

Some cooling off expected.

- The other 2 sectors that showed some recovery are Pharma & Healthcare.

- Stocks on Radar:

- GOKULAGR0, BLACK8UCK, PARAGMlLK, EPACKPE8

Keeping them on our watchlist.

⦿ From the Stocky Mind Community

Many traders still try to “catch bottoms”, lured by quick bounces in beaten-down stocks.

If you are serious about trading:

Stop searching for bottoms. Start focusing on strength.

Trade the stocks that are near their highs, not ones that look “cheap.”

Trade with the T.R.E.N.D. ⚡️

⦿ Quote of the Week

“Amateurs look for bottoms. Professionals look for strength.”

See you in the next pulse with Stocky Mind Pulse – 31 🙌🏻

If you liked this issue, share it with your trading friends.

Let’s grow smarter together 💪🏻

Best Regards,

Stocky Mind ⚡️

⚠️ Disclaimer

The information shared in this newsletter is for educational and informational purposes only.

It is not financial advice or a recommendation to buy or sell.

Please do your own research or consult a certified financial advisor before making any trading or investment decisions.