Markets Bounce, Strength Speaks

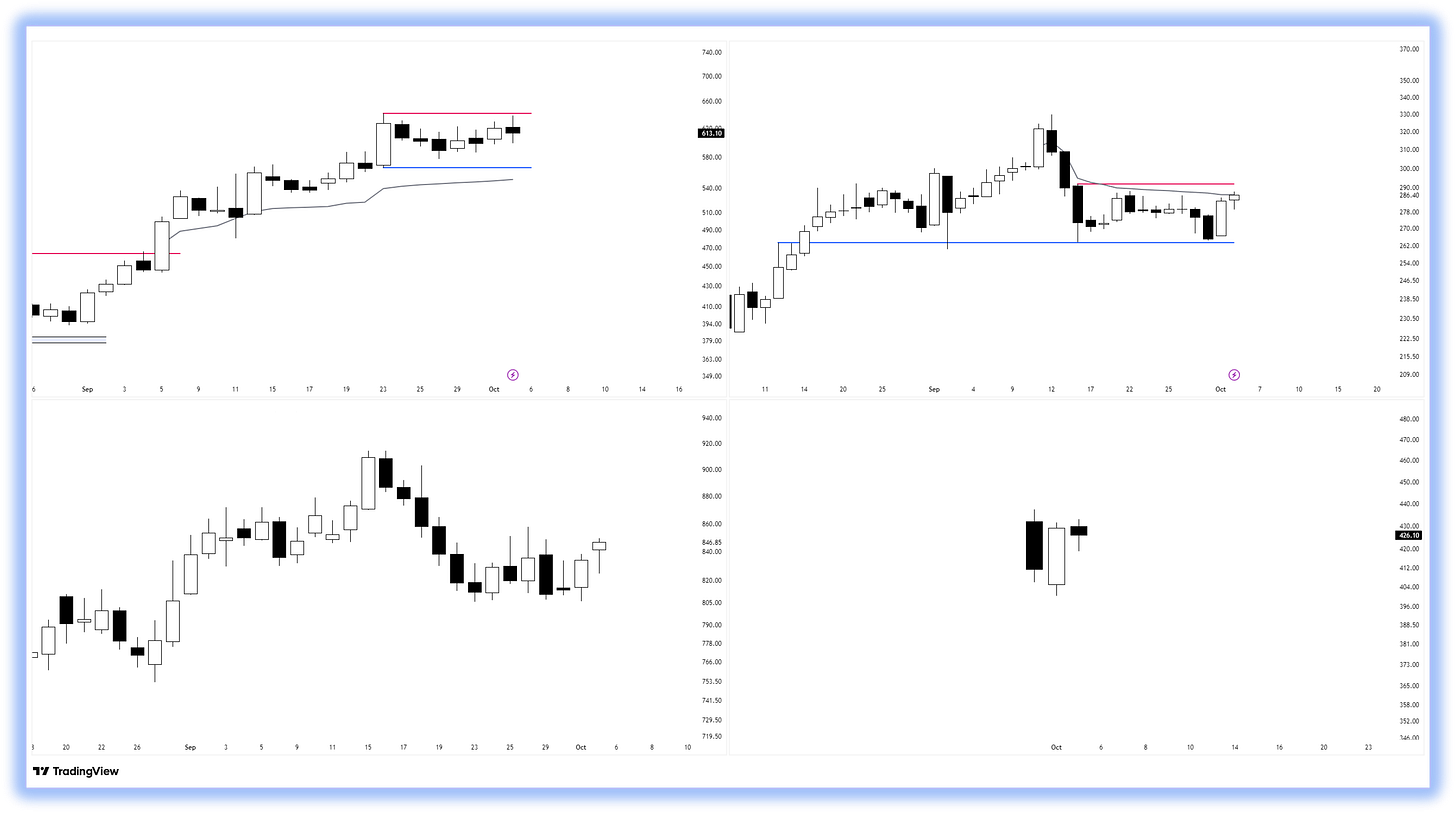

The short week ended with a bounce across the markets. Bank Nifty (2%+) led from the front, showing the strongest recovery among the top indices.

-

Defence & aerospace stocks witnessed movement after forming a base post-pullback.

-

BANCOINDIA stood tall and displayed strength without much weakness.

-

Routine: NSE changed lot sizes,

NIFTY: 75 ➜ 65

BANKNIFTY: 35 ➜ 30

FINNIFTY: 65 ➜ 60

-

Some setups are now shaping up with early signs of participation.

-

On the global front, the Dollar Index keeps climbing; probably the only bullish chart Indian traders wish would reverse!

⦿ Game Plan

✅ Positions in strong setups from strong sectors

✅ Trail profits but don’t rush exits in strong stocks

✅ Avoid weak sectors/stocks despite bounces – strength attracts more strength

✅ Keep risk light in sideways markets – capital preservation first

✅ Focus on building & refining watchlists of strong stocks from strong sectors

✅ Review failed setups to learn from what didn’t work

⦿ Sector & Stock Highlights

-

Sectors:

-

Metals: Index at new all-time highs

-

PSU Banks: +4% this week, showing leadership again

-

Auto: Stable, consolidating after pullback

-

Defence & Aerospace: Early signs of participation after base formation

-

-

Stocks on Radar:

-

GMDCL_D, IXI_O, HBLENGI_E, ST_L

-

⦿ From the Stocky Mind Community

On a lighter note, some believe Trump’s kundli may hold clues for the market’s next direction. Well, until the stars align, we will stick with our charts & setups ✨

⦿ Quote of the Week

“In markets, strength reveals itself quietly; listen to the silence.”

See you in the next pulse with Stocky Mind Pulse – 26 🙌🏻

If you liked this issue, share it with your trading friends.

Let’s grow smarter together 💪🏻

Best Regards,

Stocky Mind ⚡️

⚠️ Disclaimer

The information shared in this newsletter is for educational and informational purposes only.

It is not financial advice or a recommendation to buy or sell.

Please do your own research or consult a certified financial advisor before making any trading or investment decisions.