Bounce Week: Opportunity Appears

-

SILVER rallied another 5% this week, extending its strong momentum.

-

GOLD finally delivered a breakout from its range.

-

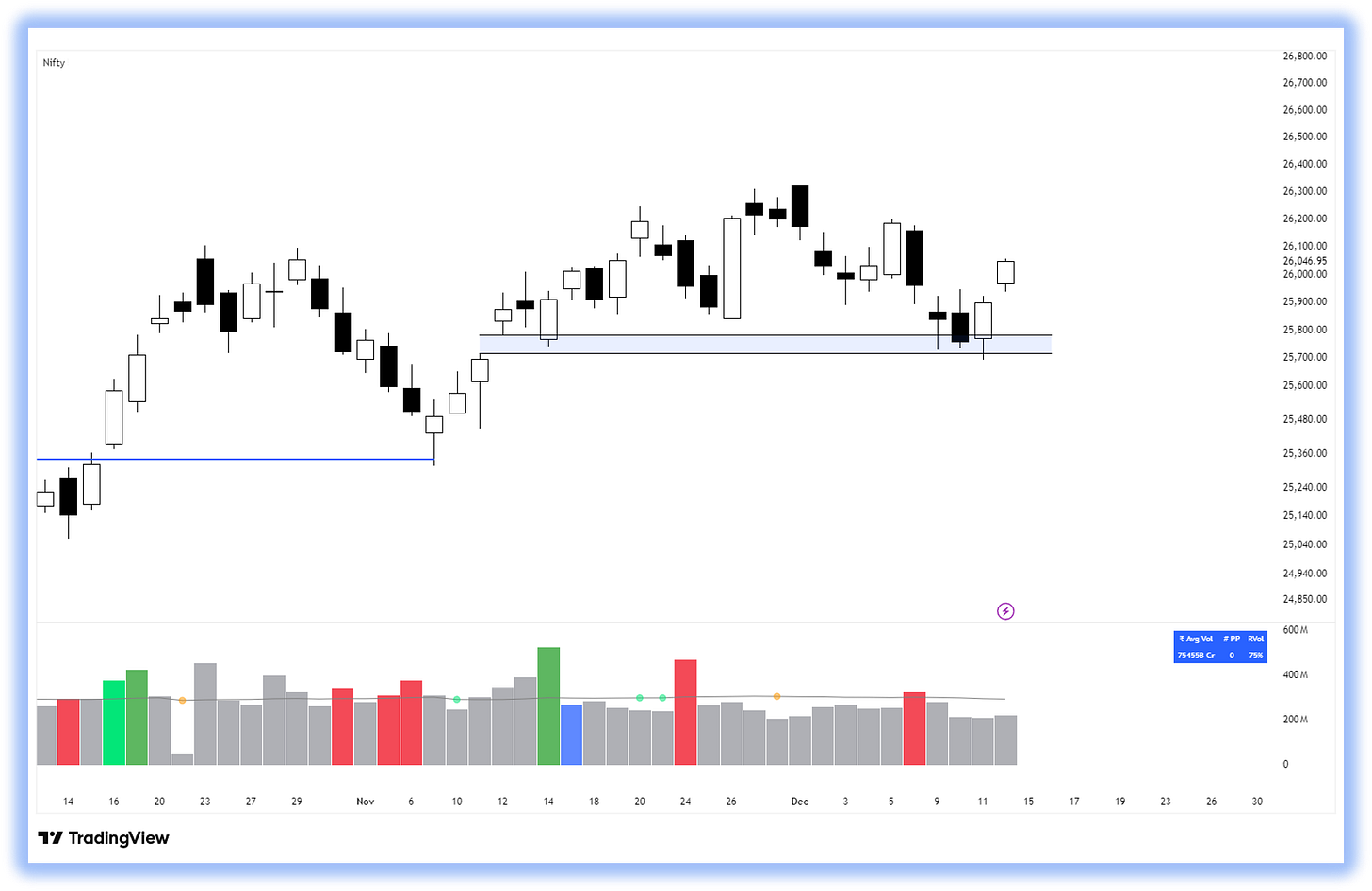

NIFTY respected the support zone and bounced.

-

Early signs of buyers stepping back in, but follow-through remains key.

⦿ What we traded this week

-

ASHAPURMlN:

· Sideways for nearly 2 weeks, showing remarkable strength.

· Held firm even when broader markets dipped; no panic selling.

· This week strong bounce with volume, aligning with market recovery.

· We added position with an SL of ~3%.

⦿ Game Plan

✔ Look for fast bounces if the market confirms a bottom

✔ Focus on fewer but high-probability trades

✔ Stay selective, stay disciplined

⦿ Sector & Stock Highlights

-

Sectors:

-

Auto: Bounced in line with the market recovery.

-

PSUBANKS: Consolidated; quiet but stable.

-

Metals: Back in focus as strength returns.

-

-

Stocks on Radar:

-

CAPlLLARY, IMF@, BELRlSE, S0UTHBANK

-

Keeping them ready for potential setups.

⦿ From the Stocky Mind Community

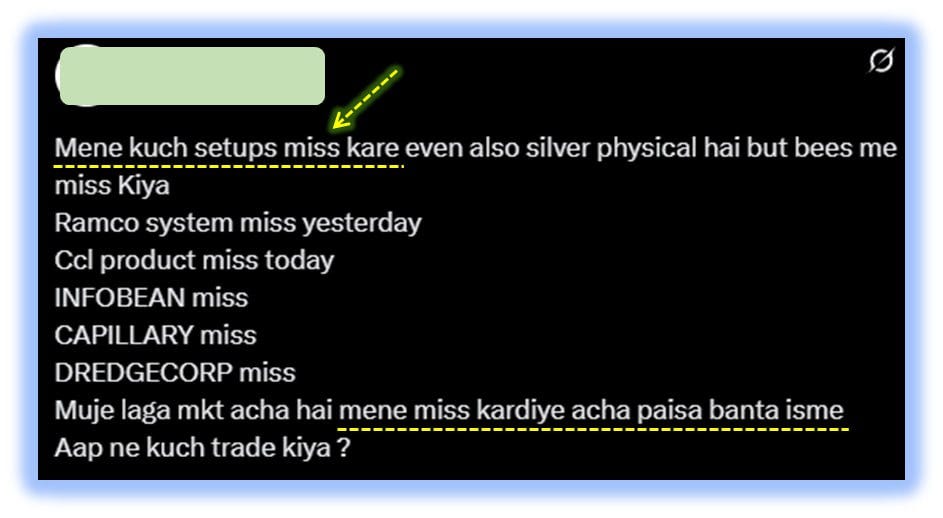

Typical retail trader with FOMO 👇🏻

No process | No conviction | No setup 😰

LEARN or LOSE ⚡️

⦿ Quote of the Week

“When the market shakes, strength reveals itself quietly.”

See you in the next pulse with Stocky Mind Pulse – 33 🙌🏻

If you liked this issue, share it with your trading friends.

Let’s grow smarter together 💪🏻

Best Regards,

Stocky Mind ⚡️

⚠️ Disclaimer

The information shared in this newsletter is for educational and informational purposes only.

It is not financial advice or a recommendation to buy or sell.

Please do your own research or consult a certified financial advisor before making any trading or investment decisions.