The Adani Trap 📉

For months, Adani stocks felt unstoppable.

Every dip was bought.

Every breakout was celebrated.

Every critic was silenced.

“India growth story.”

“Nation builders.”

The crowd was convinced.

Then…

January 24, 2023 happened.

◉ The Shock: 24 Jan 2023

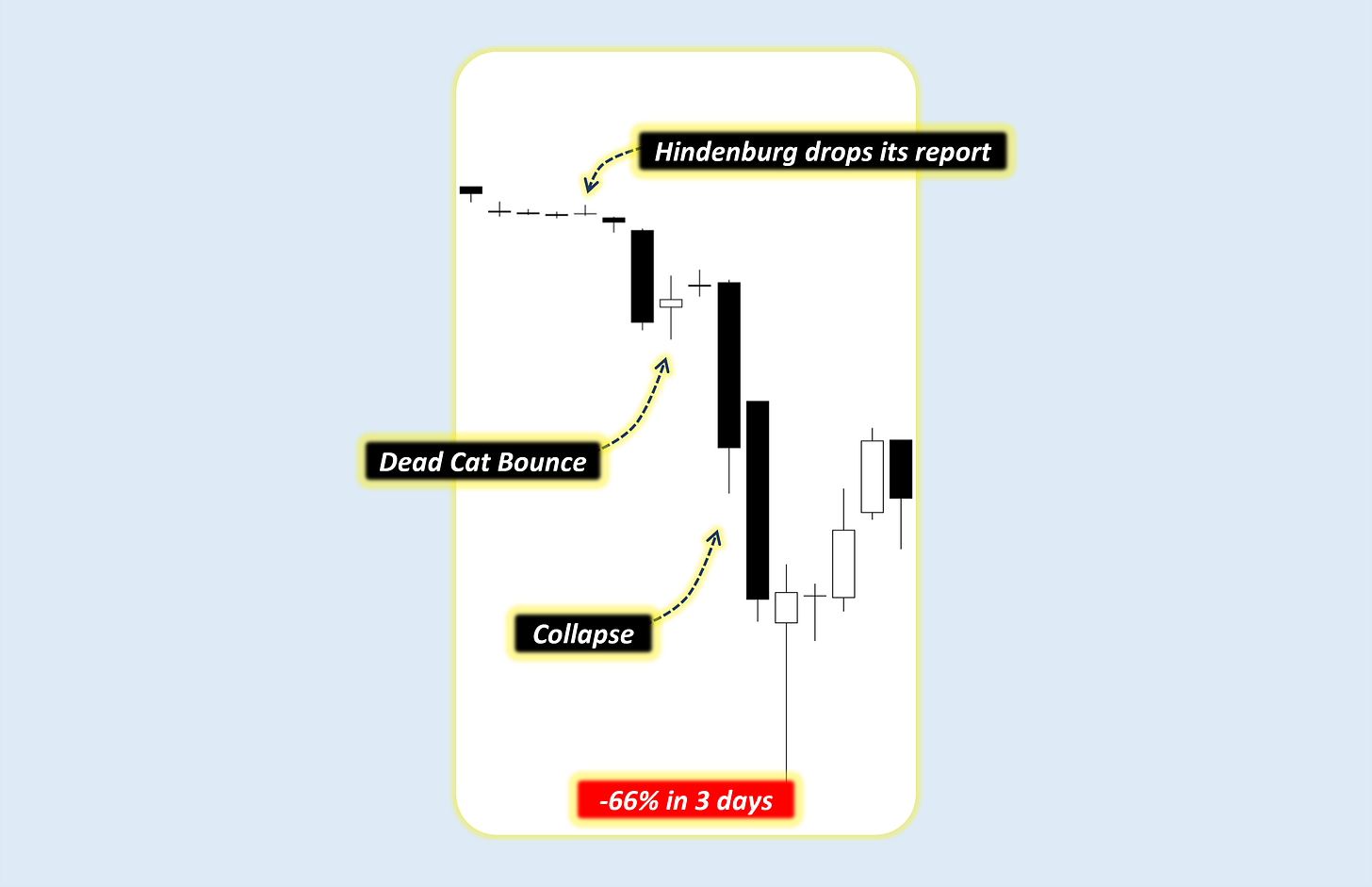

Hindenburg drops its report.

Markets open uneasy.

Adani stocks don’t crash immediately.

They hesitate.

Long upper wicks appear.

Price tries to move up…

But sellers hit every rally.

First warning candle:

Demand weak.

Supply aggressive.

Smart money already knows.

Retail is still hopeful.

◉ Panic Sets In: 25-27 Jan 2023

Next session.

Big red candle.

Heavy volume.

Support breaks.

This is where:

-

Traders freeze

-

Investors panic

-

Telegram turns silent

Still, many say:

“Healthy correction”

“Strong fundamentals”

“Buy the dip”

Classic denial phase.

◉ The Dead Cat Bounce: 30-31 Jan 2023

Market opens green.

Hope returns.

“See! It was just noise.”

People re-enter.

Averagers add more.

This was the trap candle.

Bulls walked in.

Bears waited.

Exit liquidity created.

◉ The Collapse: 1-2 Feb 2026

Now comes momentum selling.

Lower open.

Lower high.

Lower close.

SLs triggered.

Margin calls start.

Forced selling begins.

No support holds.

Price free-falls (-35%).

This isn’t trading anymore.

This is survival.

◉ Capitulation (66% in 3 days)

Long red candle.

Huge volume.

This is where:

-

Weak hands surrender

-

Emotions peak

People don’t sell because they want to.

They sell because they have to.

Fear wins.

◉ What Actually Happened?

This wasn’t just about a report.

It was:

-

Over-leveraged positions

-

Blind belief

-

“It always goes up” mindset

-

Zero risk management

When everyone is on one side…

The market looks for the exit.

◉ The Trap

Retail bought because:

-

“It always goes up”

-

“Too big to fail”

-

“Government won’t allow”

But market doesn’t care about:

-

emotions

-

beliefs

-

patriotism

Only:

Liquidity

Positioning

Risk

◉ The Real Lesson

Big losses don’t come from bad stocks.

They come from blind conviction.

When a stock becomes:

-

Social media darling

-

News headline

-

Cab-driver tip

Risk is already high.

◉ Rule From This Story

Never marry a stock.

Markets don’t reward loyalty.

They reward discipline.

◉ Final Thought

The Adani crash wasn’t a black swan.

It was:

-

Overconfidence

-

Overexposure

-

Ignored warnings

Written clearly on the chart.

Price always speaks first.

News only confirms later.